The following presents a detailed explanation of each of the seven (7) strategic innovation pathways and the four (4) strategic innovation vehicles. This will illuminate the objectives and uses of each one, and, more importantly, how a business can weave them together to pursue a specific and defined Innovation Strategy to achieve its short-term, medium-term, and long-term growth objectives.

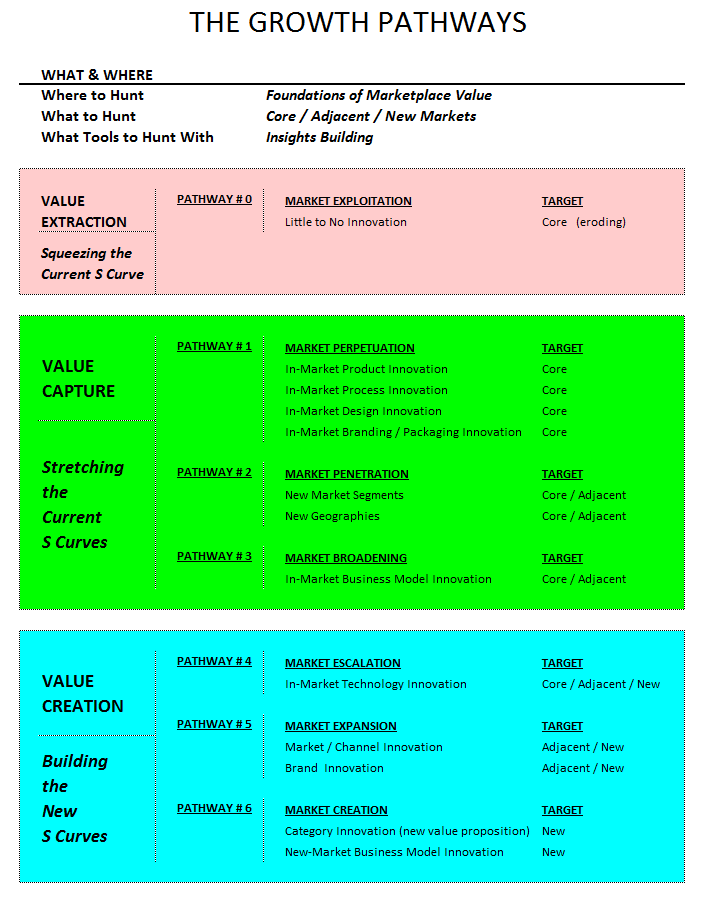

The GR5 Playbook defines six pathways of innovation–driven growth that businesses can leverage. The first three of these pathways have a Value Capture focus – stretching the current foundations of value (the current S–curves), while the latter three have a Value Creation focus – building new foundations of value (new S–curves). Each successive pathway from 1 to 6 requires a different level of organizational innovation maturity, and in many cases, a different level of "executive air cover" to ensure the organization is capable of following through on delivery.

There is actually a seventh pathway – Pathway 0 / Market Exploitation – that involves no innovation and therefore no growth. Its focus is on Value Extraction... squeezing the current S–curve until it has been fully depleted. Since this pathway drives no growth, we do not explore it any further here, except to say that lines of business that adopt this strategy have generally acquiesced to various market pressures and have resigned themselves to gradual decline and eventual cessation. Sometimes this comes quickly, and sometimes it comes slowly, depending on the speed of the particular market. This is acceptable if the time has come to retire this line of business — so long as the organization has one or more newer lines of business to replace it with. Otherwise it results in cataclysmic market exploitation, and the organization itself collapses and ceases to exist (such is often the nature of market disruption arising from any number of sources, but primarily from a lack of astuteness on the part of the business itself).

In each of the two series (Value Capture and Value Creation), the first pathway ( 1 / 4 ) is largely a technology play; the second pathway ( 2 / 5 ) is largely a commercial play; and the third pathway ( 3 / 6 ) can be equal parts of both.

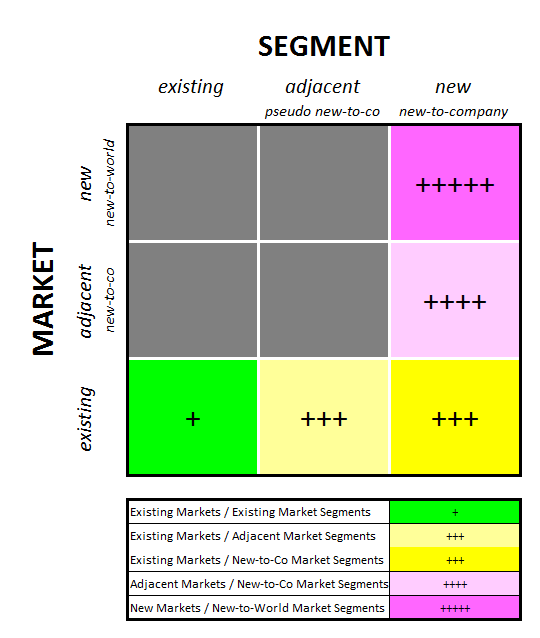

To further illustrate the second set of pathways ( 2 / 5 ), the following diagram shows the relationship between Markets (existing, adjacent, new) and Market Segments (existing, adjacent, new). The fewer the "+" marks, the easier the effort, but the lower the return. The greater the "+" marks, the harder the effort, but the higher the return. Pathway 2 usually stays within 3 "+"s (occasionally venturing into 4 "+"s), whereas Pathway 5 is always out in the 4 and 5 "+" territory – bigger risk / bigger reward / more long term payback.

Your company launches innovative new offerings within its current core markets.

This is generally a case of using design innovation, product innovation, process innovation, and/or branding / packaging innovation. In each case you are leveraging the fundamental elements of innovation – empathy, creativity, and delivery – to deliver new value and experiences to your core markets. You may brand these under existing brands if there is a good fit, or you may launch new brands to best capture and convey the essence of the offerings. All of these serve the same purpose of bringing innovative new offerings to your existing core markets.

This strategy is designed to sustain existing core markets and potentially gain a larger share of those markets.

In the case of design innovation and product innovation, this is done with a new design or configuration of your existing technologies and products. The new products will typically have a different set of attributes and performance characteristics when compared to your existing products. The innovations they represent are typically incremental or moderate. A design innovation requires product design work, while a product innovation requires product development work (these often go hand–in–hand). The technological risk tends to be low to moderate and the commercial risk low to moderate.

In the case of process innovation, this is done by leveraging new production processes for products (e.g. manufacturing technologies) or new delivery methods for services. These new processes and methods will typically bring capabilities that were not previously present, meaning new product features and performance attributes (including lower cost), or new means of service delivery, can be offered. The innovations these represent are typically incremental or moderate. A process innovation requires process development work. The technological risk tends to be low to moderate and the commercial risk low.

In the case of branding & packaging innovation, this is done with redesigned packaging and/or brand communications, and potentially revised pricing, so as to reposition (or refresh the positioning of) your offerings. This may involve restating certain aspects of the brand promise to better resonate with shifting psychographics in a particular market. The innovations these represent are typically incremental or moderate. A branding innovation requires some level of brand development work, while a packaging innovation requires package design work. The technological risk tends to be extremely low and the commercial risk low to moderate, depending on the extent of the brand shift.

Your company pursues new market segments or new geographic regions (adjacent markets) within its core marketspace.

This is generally a case of hunting for new customers within a broader market space and/or establishing new channels into new geographic markets.

This strategy is designed to gain deeper market penetration and a larger market share within existing core markets.

In the case of both new market segments and geographic expansion, this is done by aggressively pursuing previously untapped segments of an existing market. Typically the only innovations involved are potentially some branding and packaging innovation – very incremental at best. It may require work around developing new sales and marketing channels – business development and market development, respectively. Both the technological risk and the commercial risk tend to be low, though much time and energy may have to be invested for these efforts to gain traction and pay off.

Your company implements innovative new means of value–delivery and value–capture within its current core markets and/or adjacent markets.

This is a case of leveraging in–market business model innovation. Here again you are employing the fundamental elements of innovation to deliver new value and experiences to your markets, but you are doing so in a way that completely restructures how these are delivered so that you can provide better value and experiences, while at the same time recapturing more or better "value return" for your company.

This strategy is designed to broaden your existing core markets and/or claim a larger market share within those markets, possibly through the capture of adjacent segments.

In–market business model innovation is done by establishing new means of delivering value and experiences, such as rental, lease, and service models in lieu of ownership models. Often these types of innovation work because they redistribute the time, effort, and/or costs associated with product consumption or service receipt. In other words, they present customers with a new value proposition that better resonates with their actual needs. These types of innovation are often moderate to disruptive. A business model innovation requires business model design work and may incur other types of work around commercialization strategies. The technological risk tends to be low but the commercial risk may be moderate or high depending on how far the business model deviates from existing business models.

Your company incorporates innovative new technologies into its products, or innovative new methods into its services, for sale within existing core markets, adjacent markets, and/or new markets.

This is a case of leveraging technology innovation, where you employ new technologies – developed either internally or through external partnerships – to deliver new value and experiences through innovative new offerings.

This strategy is designed to escalate the foundational S–curve, and results in a new level of market presence within existing, adjacent, and/or new markets.

With technology innovation, the resulting products and services will have new attributes, new functionality, and noticeably different performance characteristics. Sometimes they are simpler and lower–performing than your traditional offerings, but cost substantially less, allowing you to sell significantly more of them and potentially into new segments that you previously had no access to (thus sometimes enabling market innovation). These innovations may be incremental, moderate, or in some cases disruptive. A technology innovation requires technology development and/or technology scouting work. While the commercial risk tends to be low to moderate (at least for existing core markets), the technological risk can be high. The commercial risk can elevate if the new technology does not deliver on the market's core needs, or does more harm than good, as immature technologies sometimes can.

Your company enters into adjacent or completely new markets with an existing, reconfigured, or new brand and value proposition.

This is generally a case of leveraging brand innovation and/or market innovation (also called channel innovation). The first is about the brand, while the second is about the value proposition. In each case you are leveraging the fundamental elements of innovation – empathy, creativity, and delivery – to deliver better value and experiences to non-core markets. Often, brand innovation and market innovation go hand–in–hand.

This strategy is designed to stake entirely new claims in existing non–core markets, thus expanding your overall market presence. Its primary result will be to take market share away from incumbent players in these markets, while its secondary result may be to enlarge the overall size of these markets.

In the case of brand innovation, you are leveraging the power of an established brand to break into a new market. The offerings may or may not be different, as it is as much about the brand as it is the value proposition. Here, the brand itself remains fundamentally unchanged, but how you communicate the brand may in fact be quite different. This is sometimes referred to as "brand stretching". Your established brand brings influence that is on par with, or greater than, brands already at play in the particular market. This means that your brand – with its particular brand promise – is perceived by some portion of these markets as superior to that of incumbent brands. In certain cases, you will develop derivative brands in order to better resonate with these markets, often with the slogan "inspired by" to tie back to the "mother brand". A brand innovation may require brand development work. Leveraging an existing "as is" brand typically involves less work than introducing a derivative brand, but not if the "as-is" brand has less resonance with the particular market. In the latter case, a derivative brand can deliver better resonance and thus better sales traction, but will still generally require more work and a larger marketing investment. Brand innovations tend to be incremental or moderate in nature, but can be radical in nature if so chosen. In the former case, the technological risk tends to be low so long as the value proposition continues to deliver on the brand promise, but in the latter case the technological risks can be high. In both case, the commercial risk can be high given the unknowns from both sides and the need to actuate your brand in the new market.

In the case of market innovation, you are introducing an existing value proposition (offering and customer experience) to a new market. Within this new market, your value proposition is perceived as better than what the market previously had access to or had been accustomed to. Thus, your value proposition need not be new to the world, or even new to your company, only new to this particular market. A market innovation requires market development work, which often begins with market scouting to identify the best potential markets to enter into. The market development work can either be straightforward or very complex, depending upon how different the new market is from the company's existing markets, and how many new market and sales channels must be cultivated. Market innovations tend to be incremental or moderate, but in some cases prove disruptive when the value proposition they bring is substantially better than that of existing offerings. As a result, the technological risk tends to be low so long as your technology meets this market's needs. The commercial risk, however, may be quite high given the unknowns from both sides and the need for the value proposition to resonate with this new market and be congruent with the brand message presented.

Your company creates an entirely new market by creating an entirely new product or service category or an entirely new–to–the–world business model. Of all the pathways, this one is the most radical and impactful, typically disrupting older models of value delivery.

The first approach involves category innovation, while the second involves new–market business model innovation. In both cases you are leveraging the fundamental elements of innovation to birth new markets.

This strategy is designed to give life to entirely new markets, starting from ground zero, and give the initiator a first–mover advantage. The first–mover advantage offers a 100% market share in the beginning and usually helps to maintain a larger market share over an extended period of time. Eventually, first–mover advantages wear off as competitors enter the space and quickly iterate to catch up. This is where strong intellectual property protections can help preserve the first–mover advantage for an extended period of time.

Category innovation involves the development and commercialization of an entirely new category of products or services that does entirely new and/or different things. It almost always involves a new synthesis of pre–existing technologies (or, in the case of services, methods). In some cases it can involve the development of a new technology, or the adoption and rescaling of a technology from a different domain.

Given that overall consumptive behavior (on the customer side) tends to be somewhat fixed, these new categories almost always cannibalize the sales of some other category because they, at least in part, do the same things but in a better way or at a lower price. Thus they are substitutes for something else, though customers sometimes end up owning and using both categories for some period of time (how long depends on the relative strength of the new category relative to the "entrenchment factor" of the existing category). Despite the potential cannibalization of one's own offerings, category innovations tend to be accretive in the balance of things, boosting total sales revenues when compared to foregoing the category. This is particularly true over the long run, where the chances of a competitor being the first to launch the new category can be high. These new product and service categories may also result in the cannibalization of tangential categories arising out of shifts in consumptive and/or lifestyle patterns that occur as a result of the new category. Overall, category innovations tend to be highly disruptive, though the disruption can take months, years, or even decades to fully replace the category it supplants.

A category innovation requires category development work, which is much like rolling technology development, product development, and market development work all into one endeavor. While they do not always demand a new brand, they sometimes get one, depending on how your company wishes to leverage its brands, and how well the new category fits with those brands. With most category developments, the technological risk will be moderate to high and the commercial risk will almost always be high, though sometimes good market insights can identify cases where the commercial risk is low.

New–market business model innovation involves establishing entirely new ways of delivering value and experiences that result in entirely new markets. They generally entail a new value proposition based on a new combination of existing products and services, or a new market delivery vehicle based on a new combination of existing channels, or both. As with in–market business model innovations, they often work because they redistribute time, effort, and/or costs, but in this case in such a way as to give rise to entirely new markets. They tend to be highly disruptive. New–market business model innovation requires business model design work, including, typically, lots of work around the commercialization strategy. The technological risk tends to be low to moderate, but the commercial risk tends to be very high depending on how well the new business model can capture new value and actuate the new market.

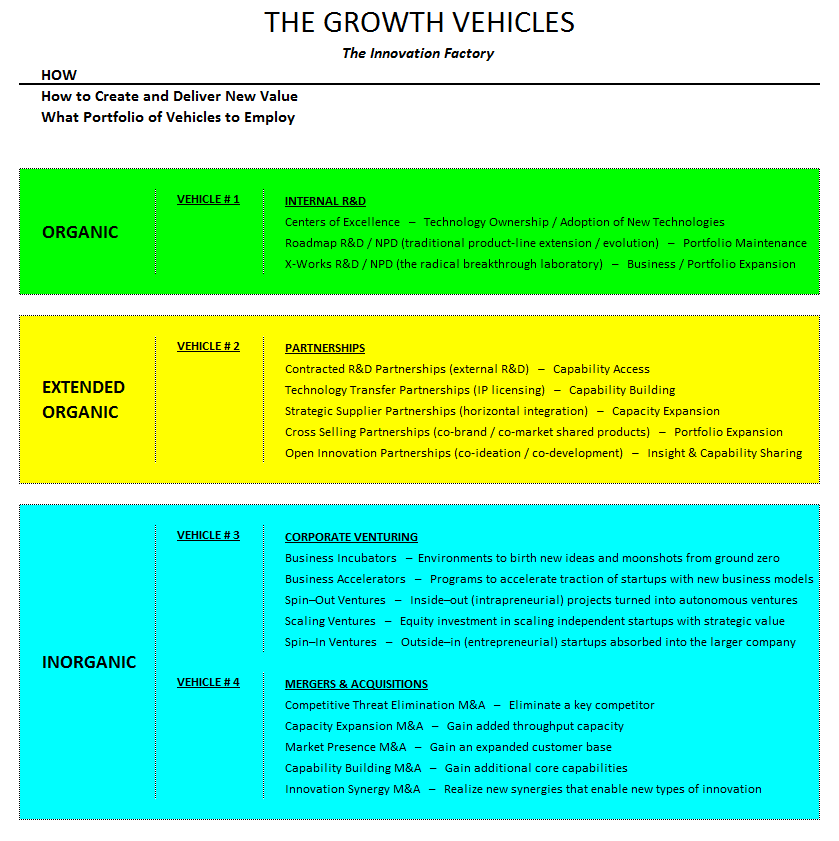

The GR5 Playbook identifies four vehicles that businesses can leverage to create and deliver new value to the marketplace. The first is a purely organic vehicle, while the second is an extended organic vehicle, and the last two are inorganic vehicles.

Each of these distinct vehicles has a unique:

Your company undertakes its own Internal Research & Development programs to develop new technologies / methods and its own Internal New Product Development programs to develop new product and service offerings. These can be for core, adjacent, and/or new markets.

There are three key types of Internal R&D / NPD:

Each of these serves a different purpose. The first typically finds its home in the Office of the Chief Technology Officer (CTO), while the second is often home to this same office or to front line business units. The third often finds its home in the Office of the Chief Innovation Officer (CInO), as its focus is very different from Roadmap R&D.

Vehicle 1 represents organic growth.

Centers of Excellence exist for two reasons: 1) to shepherd the maturation of existing and newer technologies in order to ensure that teams attempting to implement them are given the support they need to do so; and 2) to facilitate the adoption of new technologies and practices over time (technology growth).

Managed by teams of Subject Matter Experts, Centers of Excellence serve as the central repository of knowledge and know-how within the organization. They are the "keepers of the flame" – a very central and perpetual part of the organization's technical capability infrastructure.

The main benefit of Centers of Excellence is the ability to completely absorb and master the organization's core technologies and capabilities, and to thereby enable front line NPD projects to be executed quickly and predictably with fewer unknowns and fewer rework cycles. Another benefit is that by serving as the central repository of knowledge and know-how, they ensure continuity within the organization over time, as successive staff members will invariably join and leave the organization.

Roadmap R&D / NPD is focused on traditional product–line extension and evolution. Its concern lies in maintaining the current portfolio of offerings and optimizing their monetization... shepherding the bread–and–butter revenue sources for the here–and–now. It does so by freshening, broadening, and otherwise improving today's offerings.

Roadmap R&D is inherently tied very closely to the front line needs of the organization – as realized through the various business units and where they are going with their markets. And even though the offerings and the market strategies developed may in fact be innovative in their own right (covering any of the first five pathways), this is still considered the most "traditional" means of pursuing new innovation. The outputs tend to span only the short–term time horizon – Horizon I, with a focus primarily on core and adjacent markets.

The benefits of Internal Roadmap R&D include complete control over the technology / product roadmap, cost–effectiveness of the business operation, and the ongoing development of core in–house technical capabilities.

Another benefit of all forms of Internal R&D is that they provide the organization with a level of control over the work and with venues for developing the organization that simply do not exist when using external vehicles.

The main drawback to any type of Internal R&D is that often, because the organization is embedded in existing frameworks and paradigms, it tends to get stuck inside of entrenched business models, rigid business ecosystems, stagnant government regulations, and waning value propositions. This can produce very myopic and linear growth paths that miss opportunities that simply cannot be seen from the vantage point of these frameworks and paradigms. In other words, the organization's own four walls can work to its disadvantage when it comes to finding the large–scale innovations it needs to secure its future.

Another benefit of all forms of Internal R&D is that they provide the organization with a level of control over the work and with venues for developing the organization that simply do not exist when using external vehicles.

The main drawback to any type of Internal R&D is that often, because the organization is embedded in existing frameworks and paradigms, it tends to get stuck inside of entrenched business models, rigid business ecosystems, stagnant government regulations, and waning value propositions. This can produce very myopic and linear growth paths that miss opportunities that simply cannot be seen from the vantage point of these frameworks and paradigms. In other words, the organization's own four walls can work to its disadvantage when it comes to finding the large–scale innovations it needs to secure its future.

Your company engages in any number of several types of partnerships, each with their own particular objective, benefit/drawback profile, and intended outcome. This is typically done to augment the organization's capabilities in developing and delivering new products and services, including access to a broader base of technologies and methods. However, it may also be done to avail the organization to outside thinking around how new value can or should be delivered to markets, particularly in the case of new and emerging markets.

There are five key types of partnerships:

Vehicle 2 represents extended organic growth.

Contracted R&D partnerships involve the engagement of various types of Contract Research Organizations (CROs) and/or contract Design and Engineering agencies. These are entered into for the purpose of expanded capability access – gaining access to additional R&D resources, or R&D resources having special skills and competencies beyond what the organization possesses internally.

The main benefits of these partnerships are the ability to access new capabilities you otherwise would have no access to, and to do so faster than can be done through developing the same capabilities in–house.

The main drawback of these partnerships is the missed opportunity to develop certain capabilities and know–how inside the organization. This may mean the organization remains dependent on the contract partner for maintenance and extension of the technology throughout the duration of its use, or until such a time as the technology can be assimilated internally. This may also mean that internal Centers of Excellence are unable to give front line NPD teams the support they need, and those teams again have to rely upon the external partners for support.

Technology Transfer (TT) partnerships are entered into for the purpose of capability building – building new capabilities and know–how within the organization from outside sources. The most well known form of TT partnership is that between businesses and universities, where new technologies and capabilities developed within university laboratories are taught to, shared with, and otherwise licensed to corporations. Another form of TT partnership is the licensing of Intellectual Property from private sources, such as inventors and other companies, where the business pays royalties to use the IP, and the licensor provides whatever training is needed to implement it.

The main benefit of these partnerships is their rapid and potentially cost–effective access to new technologies and new technological know–how. This allows an organization to deliver new product and service capabilities faster than it could through Internal R&D. It also introduces a step-change in the organization's technological knowledgebase, meaning that Internal R&D may be able to deliver subsequent generations of the technology much faster than it would have otherwise.

The main drawback of these partnerships is the potentially high costs associated with licensing the technology. As with any investment, the company should be convinced that the deal represents a realistic and attractive return for them, including a real market need for the technology / capability and their ability to commercialize a viable offering from it. This often means undertaking certain due diligence in order to justify a particular TT partnership.

Strategic Supplier (SS) partnerships involve one company enlisting another to provide either key elements of an offering or added production capacity (for example, a Contract Manufacturing Organization, or CMO). This avoids the need for the company to be vertically integrated. Thus, generally speaking, these are entered into for the purpose of capacity expansion – gaining access to additional throughput capacity for delivering offerings beyond what the business otherwise has internally.

The main benefits of these partnerships are the ability to scale offerings across a larger market base than the company otherwise could, and the added flexibility of being able to scale up or down quickly as market needs dictate. This can allow companies to enter into new geographic regions and/or adjacent markets they otherwise would not take on.

The main drawbacks of these partnerships are that cost–efficiencies may be missing (meaning a higher cost structure) and Quality Assurance (QA) measures lie outside of the organization's direct control. The former will result in profit erosion. The latter has the potential to result in higher–than–desired defect levels, which can lead to brand erosion and subsequently revenue erosion. Both of these are risks that must be balanced with the aforementioned benefits, and will depend on the company's particular risk / reward tolerance level.

A Cross Selling partnership – aka Product & Brand Sharing – involves entering into a business arrangement with a partnering business in which the two companies cross–brand, cross–market, and/or cross–sell one another's offerings. These may be one–way or two–way, depending on the goals of the partnership. An example of one–way is private labeling.

Cross Selling partnerships are used to achieve one or more of three separate aims – rapid portfolio expansion – having additional offerings to help fill out one's portfolio in a given market, new market entry – for example, combining one company's product presence with another company's geographic presence, and/or brand building – leveraging the combined power of both brands to create a super brand, something that benefits both businesses (though not always equally). Sometimes these partnerships are used to build relationships between businesses contemplating an eventual merger or acquisition.

The main benefits of these partnerships are the opportunity to build relationships with allied business partners and the ability to rapidly expand one's presence in a particular market. The latter will help each business realize additional revenues and – more importantly – potentially gain additional market share. Just as importantly, these benefits accrue without having to invest in additional R&D or NPD. This holds the potential in some cases to produce rapid growth for one or both companies, depending on the situation. Certainly it should result in revenue growth for both parties, if only producing real market share gain for one of the parties.

The main drawbacks of these partnerships are threefold – the necessity to split revenues, the complexities associated with sharing brands (and to a lesser extent products), and potentially some added logistical costs and delays in moving products around. The need to split revenues means that although a given company may gain market presence and market share, it may or may not realize additional profits from these offerings, and in some cases can even lose money on them. This must be balanced with the broader value of an enlarged market presence, which will likely produce profits from other offerings.

Open Innovation (OI) partnerships are entered into for one (or both) of two purposes – insight sharing and capability sharing. In the first scenario, the company is looking for fresh new ideas around how to address a particular market challenge or trend. In the second scenario, they are looking for specific solutions or capabilities that they themselves don't have (often tech–enabled solutions) for attacking an identified market opportunity. OI partnerships can be structured in a variety of ways, from very loose to very tight, depending on the types of stakeholders involved (e.g. business–to–business, business–to–employees, business–to–public, etc.) and the scope of exchange being sought.

In the case of partnering to find new ideas, these are typically run as very loose "partnerships" where the company (the "idea needer") solicits targeted new ideas from a community of "idea providers", using varying degrees of openness or closedness. Sometimes companies run campaigns to solicit and collect as many new ideas as possible (these being closed, semi-open, or fully open) – ideas it will later evaluate for viability in real business models. It is not uncommon to see idea–management software used to run these campaigns. At other times, select companies come together and cross–pollinate ideas with each other to accomplish a particular focus that one or more wishes to address. These can be either structured or unstructured sessions. This can be particularly productive when the companies come from different industries, as it will often produce lateral thinking around very different ways of doing things.

In the case of partnering to gain access to new capabilities, these tend to be somewhat tighter partnerships where the company (the solution needer) solicits partnerships from outside partners (the capability providers) who have the appropriate capabilities and know–how to address their need. This is sometimes facilitated by an online OI Portal, where the two parties advertise needs and solicit capabilities, respectively, and the portal service seeks to match the two. These partnerships tend to have more formal business terms tied to them.

The benefits of OI partnerships are the ability to rapidly conceive innovative new market solutions, and then to bring these solutions to market in the form of impactful new products and services – both of which the company would otherwise be unable to do – and all without having to invest years and large sums of money in market research and Internal R&D. This can substantially jump start their ability to deliver new value to the marketplace and achieve a position of market leadership, greatly accelerating their overall growth trajectory.

The main drawbacks of OI partnerships, besides the challenge associated with finding the right partners and managing the partnership, are the need to manage expectations around Intellectual Property (IP) rights, and the potential need to share IP rights with solution providers, according to an agreed–upon legal arrangement. This runs counter to many traditional organizations who expect 100% ownership of all IP rights, but is the tradeoff that is sometimes made to gain access to fresh new ideas and the fresh new technologies and methods the organization needs but does not otherwise have. There is also the drawback that the know–how and capabilities associated with the technology may not fully transfer into the organization, and so there are limitations from a capability–building standpoint. Also, as with Contracted R&D, an OI partnership may create certain types of partner lock–in throughout the life of an offering using its technology. These risks must be balanced against the rewards of fast growth and the reduced technical risk of using a proven technology or method.

Finally, there is the caveat that bringing something to market that is completely new to the company, using technology or methods that are completely new to the company, may in fact make the company (or at least that part of the company) feel "out of its element". This can require careful management to help the company grow into that space. The alternative is to spin out a new venture with the new offering and business model and let it learn from the ground up, which it will likely do more quickly than will the current organization. Then, as that venture matures, decisions can be made concerning how best to reintegrate it back into the parent business.

Your company invests in one or more of several types of ventures, each with a particular objective, risk/benefit profile, and expected outcome. This is typically done to augment the organization's ability to deliver breakthrough innovations, including fresh new business models that can win new stakes in the marketplace. These new approaches tend to focus more on value–creation (building new markets with new customers) than on value–capture (working existing markets), as established organizations otherwise like to do. Thus they often serve as a high value complement to what organizations are otherwise pursuing.

As a business strategy, Corporate Venturing is suited to commercializing any of the three value–creation pathways (4, 5, & 6), but in more of a "safe sandbox" mode. It provides the company with access to fresh new perspectives on its markets – perspectives unencumbered by the entrenched (and potentially outdated) frameworks, ecosystems, regulations, and business models, all of which gave life to the current (and potentially waning) foundation of value. Each of these ventures provides a vehicle for pursuing a completely new foundation of value... a completely new S–Curve. This can at times result in quite unexpected and serendipitous outcomes – the hoped–for payback. It can just as well result in disappointing outcomes too, which is to say that these unproven ventures are not without their risks. Overall, for every ten startup investments, five or six will eventually fail, three will achieve a moderate return, and one or two will achieve breakthrough results (100X or greater). The "safe sandbox" serves to isolate existing high–value brands from the ramifications of any fall–out associated with the failures.

There are five key types of ventures associated with Corporate Venturing:

This list progresses in order from lowest cost / highest risk to highest cost / lowest risk.

Vehicle 3 represents inorganic growth.

Incubators are places and environments used to help "incubate" nascent business–model / value–proposition ideas (including some so–called "moonshots") from ground zero to a point where they can demonstrate some level of commercial viability. Involvement in incubators provides corporations with exposure to fresh, and sometimes radical, new thinking around ways to deliver better value and experiences to their core markets and to new markets, all of which represent viable (albeit highly nonlinear) paths of growth for the business. Some companies have even gone so far as to set up their own private incubators in–house. On the other side of the table, incubators typically provide founders with access to working capital, office space / technology, and business mentors having broad business networks.

The main benefit of being involved in incubators is exposure to completely new blue–ocean business models and offerings that the organization itself would probably have never thought to pursue, or which represent such foreign approaches that they would be deemed too great a risk for internal pursuit (i.e. they would prove a distraction to lower–risk, more assured investments). Incubator investments circumvent the entrenched antibodies inside of organizations that tend to quickly kill off such radical ideas about how to approach a market. Since many of these new approaches will require time to take hold, investments in incubator–level startups should be thought of as the (very) long term businesses and offerings that gain access to tomorrow's markets and customers, more so than to today's markets and customers. This is what makes them a powerful tool for long term business resilience – they're insurance against "the innovator's dilemma".

The main risk with incubators is the known fact that each investment is in actuality a "business experiment", with the greater proportion of them proving nonviable. This is because most of them are predicated on select future scenarios playing out on a certain timeline and are therefore highly speculative. They also tend to be fronted by unproven teams of entrepreneurs. Thus, one must invest in a relatively large portfolio of incubator bets if they are to have any reasonable odds of scoring a breakthrough winner. This means the overall investment cost can be high, but the payback can also be high given adequate patience. There is also the risk from the corporate side of wanting to jump in and micromanage the startup like it is a piece of the corporation. This can prove disastrous for the continued viability of the startup, as the startup requires autonomy to grow and evolve in its own organic way, without artificial derailment from a corporate mindset. The investing business must therefore guard against this temptation.

Accelerators are programs used to help "accelerate" young new startups that have begun to demonstrate (or are poised to demonstrate) some level of market traction through real revenue growth. Most of these will have received various rounds of pre–seed and seed investment from the accelerator or from Angel Investors, and may potentially receive a Series A round from a Venture Capital or Corporate Venturing fund toward the end of their time in the accelerator. The aim of the accelerator is to help facilitate further investment funding so that founders can scale their business and take it to the next level toward becoming established. On the corporate side, these investments provide the corporation with access to fresh new business models and offerings that deliver different value and experiences to both existing and new markets, representing viable (albeit nonlinear) growth paths for the business.

The main benefits of being involved in accelerators are access to up–and–coming new business models and/or offerings that the organization itself might never have pursued, perhaps because they would have been deemed too risky, and at a stage that is still relatively cost–effective to get into. As with incubator investments, accelerator investments also circumvent the antibodies inside of organizations that tend to kill off new ideas. As a result, accelerator investments tend to produce the medium and long term businesses and offerings that gain access to new markets and new customers, while also providing a path of conversion for current markets and current customers. This is what makes them such a powerful tool for sustained business growth and resilience.

The main risk with accelerators is the consideration that, despite the fact that each startup may have begun to demonstrate traction, ultimately they are still in the "business experiment" stage. Most of these are still predicated on market hypotheses that are as–of–yet not fully proven, not to mention the unknowns around their founders' ability to move beyond a minimal viable product to something that is robust enough to scale. Thus, as with incubator investments, one must invest in a relatively large portfolio of accelerator bets if they are to have a reasonable chance of finding the breakthrough winners. This means the overall investment can be high, but the payback can be even higher as long as there is adequate patience.

A Spin–out Venture is one in which your company launches a fully–owned independent startup business. The aim is to prove out one or more of the value–creation innovations more rapidly and more nimbly, and with less risk to the company, than could otherwise be done inside the company. These represent high risk / high growth–potential business opportunities, and often require a long term mindset to demonstrate success. The venture will have its own management team and board of directors, and its own operating structure.

Spin–out Ventures often arise out of intrapreneurial endeavors inside the company. Over time these "inside–out" projects evolve into real businesses, but the type of business best suited for life outside the company. They involve an entirely new business model, a new technology, a new product, or a new category that is best commercialized independently, or else they take aim at very different markets than the company is familiar with. These typically represent moderate to disruptive innovations.

More often than not, Spin–outs have to operate like a lean startup, which means they require autonomy – their own operating structure and their own governance procedures – so that they can get into market faster and iterate their learnings faster. This serves to maximize their chances of long term success. They typically launch with their own brand, which further forces them to stand on their own two feet.

The primary benefits of Spin–out Ventures are the ability to test out new business models and new offerings – possibly in new markets – in a way that quickly validates their market viability, and the ability to do so while shielding the company and its high–value brands from negative repercussions should the ventures not succeed. Over time, this will yield high returns as it allows the company to discover new foundations of value that can have a big impact in the marketplace. And all of this happens with 100% equity in each venture, so there is no dilution of returns when they do succeed. Most importantly, Spin–outs, like other investments, can turn into the long term businesses that capture tomorrow's markets and customers long after today's markets and customers are gone. This makes them a powerful instrument of resilience, and further insurance against "the innovator's dilemma".

The primary risks of Spin–out Ventures are the capital outlay they require, and the fact that they themselves involve inherently high risks, both technological and commercial. The organization will have to balance these risks against the potential rewards when orchestrating its investment portfolio.

Joint Spin–out Ventures are a variation of independent Spin–out Ventures in which two or more businesses partner together to launch a new high–growth venture being spun out of one of them (or possibly out of a pre–launch collaboration between them). As with independent Spin–outs, the aim is to prove out one or more of the value–creation innovations rapidly and nimbly, and with less risk to the partners, than could otherwise be done inside either one of them. Similarly, the venture will have its own management team and board of directors, and its own operating structure.

Unlike traditional Joint Ventures, or JVs, in which companies combine resources to create a new business so as to capture a particular low risk, moderate growth business opportunity, the focus of Joint Spin–out Ventures is on capturing a high risk, high growth–potential – possibly longer term – business opportunity. These innovation bets often come about because the partnering companies share a common insight into an impending trend that requires a completely rethought business model and offering, one in which they believe they can best go after together. Otherwise, the venture may have a similar construct and investment/return sharing arrangement as a traditional JV, but its focus, and typically its operating methods, will be quite different.

The primary benefits of a Joint Spin–out Venture are the same as an independent Spin–out Venture (sans 100% equity), plus the fact that its risk is spread across more than one enterprise, and the venture has access to the insights, perspectives, and resources of more than one business.

The primary risks of a Joint Spin–out Venture are the same as those of an independent Spin–out Venture, plus the fact that the returns must be split, and if the venture succeeds and begins to scale, the question will have to be addressed as to how to evolve and mature it in the long run, in terms of keeping it independent or spinning it back into one of the businesses. This may require an eventual buy–out by one of the partners, which would tend to occur when there is high enough confidence in the venture's scalability, but prior to it scaling overly large. Even still, under these circumstances, the return should be very lucrative for the selling partner... some large multiple of their original investment.

A Scaling Venture is one in which your company invests in an independent startup business for the purpose of helping it scale to a size that is of financial and strategic significance to your company. These investments are made strategically, which means the selected startups are carefully chosen based on an affinity to your core business strategy. Generally speaking, your company will not be the only investor in these startups (shared investing allows for shared risks and enables you to spread your own investments more broadly). In fact, yours may be part of a post Series A round of investing (e.g. a Series B, C, or D round). But the intention in your case is that once the business has been able to scale to a point that proves its market relevance you will assume the controlling equity position in it. This means you have to ensure there is a path to that position. Upon assumption of controlling equity, your company may choose to continue operating the business as a separate entity, or spin it into the company under an established brand (see Spin–in Ventures below).

In a Scaling Venture, you are dealing with one or more of the value–creation innovations – typically ones that are moderate to disruptive for the situation – and what you are essentially doing is using the venture as a vehicle for further testing the innovations – not to see if they are viable (that has already been proven) – but to see whether or not they are ready to be adopted more broadly within and across markets. Their ability to scale up validates this; an inability to scale up proves otherwise. Scaling Ventures will have their own operating structures and their own sets of governance and gating procedures, which tends to make them comparably more nimble and fast, and which should in theory help them be able to maneuver quickly in finding the fastest possible routes to scale. This may require other types of assistance from investors however, beyond purely financial investment (e.g. sharing established sales and marketing channels).

The primary benefits of Scaling Ventures are the ability to test out the broader acceptance of new business models and new offerings – possibly in new markets – and hopefully actually scale them to a size of significance, together with the ability to do so while shielding your company and its brands from negative repercussions should the ventures fail to scale. Over time, this will yield high returns as it allows your company to further develop and mature new foundations of value for a significant impact in the marketplace. Most importantly, Scaling Ventures hold a high potential for becoming the long term businesses that will capture tomorrow's markets and customers long after today's have come and gone, making them yet another effective instrument of resilience and further insurance against "the innovator's dilemma".

The primary risks of Scaling Ventures are the capital outlays they require, which can be large, and the fact that they themselves still involve moderate to high risks, both technological and commercial, as their ability to scale and be profitable has heretofore been unproven. Your organization will need to balance these risks against the potential rewards when orchestrating its investment portfolio. Another important consideration to be made here is the very real risk that over time these new ventures will substantially displace your company's current offerings (as well as those of your competitors), which is why it is so important that your company be prepared – and in a position – to take the controlling equity stake when the moment is right.

A Spin–in Venture is one in which your company takes a controlling equity stake (most often a 100% equity position) in an outside new venture for the sole purpose of integrating it into your core business ("spinning it in"), typically under one of your existing brands. These investments are made strategically, meaning any venture selected is congruent with your core business strategy and has either scaled or demonstrated an ability to scale to a point that it is financially attractive to your company. Integration may be slated for the near or distant–near future, typically on the order of immediate to two years. Because you are taking a controlling or full equity position, you will be buying out its current investors, some of whom may have supported the venture through multiple rounds of funding. As such, this represents the "exit" for those investors. Those investors will classify this exit as an M&A acquisition (as opposed to going public via IPO).

Because you are integrating the new venture, this can be thought of as an "outside–in" business experiment in which an entrepreneur successfully scaled one or more value–creation innovations into a real business with broad market traction (and which is now prime for either integration into a larger company or becoming its own publicly–traded company via IPO). Spin–ins almost always involve moderate to disruptive innovations, otherwise the incentive to invest the time, effort, and capital to spin them in would not be compelling enough to do so. As you begin to integrate the venture into your larger organization, you will generally alter or replace its operating structure and governance procedures with your own. This must be managed carefully so as not to undo the strides previously made by the venture, some of which may have been tied to its ability to operate nimbly and adapt quickly. To the extent that these are critical pieces of its business model, they cannot be "lost in translation", despite temptations otherwise for operating efficiencies. Your company will have to find ways of preserving those capabilities, and in fact, this may signal the need for changes in your own operating structures and procedures. These decisions must be made on a case–by–case basis, but they must be made with an open mind that what allowed the new venture to thrive may have in fact been its very different ways of thinking and working relative to those of entrenched companies like your own. Whatever your company ends up bringing to the table, it cannot be toxic to the Spin–in, otherwise your investment will have been for naught. Instead, your company must find ways to continue nurturing the venture as a key part of its evolving growth strategy, and this may require adaptation on your part.

The primary benefit associated with Spin–in Ventures is the opportunity to take the fruit born out of a successfully scaled startup and amplify that further into something even more impactful. This happens by marrying the successful new approach validated in the venture to an existing brand with an established presence. Managed correctly, this has the potential to produce substantial growth, particularly as the new model continues to gain acceptance over time and further builds the brand. Since the ventures being spun in have already proven their viability and scalability, the actual technical and commercial risks tend to be low, and in fact are largely mitigated by this point. As such, Spin–ins tend to produce very high returns because they bring proven new foundations of value with real, tangible impacts in the marketplace. Most importantly, a Spin–in becomes a key part of your company's future identity – providing the resilience you need to continue growing as existing markets evolve and new markets emerge.

There are three primary risks associated with Spin–in Ventures. The first, and most obvious, is the large capital outlays they require, comparable in some cases to the cost of acquiring more established businesses, depending on the industry, the venture, and the stage of growth the venture has reached. Your company will need to balance this against expected returns. The second risk involves your company's ability to actually integrate the new venture without harming what made it work in its native form, which is why your company must be prepared in some cases to undergo change itself if necessary to ensure the overall successful evolution from one foundation to the next. The third risk is the "opportunity risk" of not spinning in a particular venture whenever there is a high likelihood that this venture has the ability to disrupt your current business. Missing such an opportunity may well mean that one of your competitors captures it instead, or the venture goes public and becomes a head–to–head competitor in its own right. This can put your company at an incredible disadvantage moving forward, potentially forcing it to scramble to play catch–up and in the end costing it more than the venture might have in the first place.

Your company acquires or merges with another company for a specific growth–based purpose. In most situations, this is to gain access to additional markets, capacities, or core capabilities, or to eliminate a competitive threat. These remain legitimate uses of M&As. There is a more progressive use of M&As however, one that is practiced in particular among very fast growth companies. It is to acquire or merge for the purpose of creating an innovation synergy – an entirely new set of capabilities or offerings that are highly differentiated and that cannot be easily duplicated otherwise. Over the long run, it is these types of M&As that hold the greatest potential for building substantially resilient growth–oriented businesses.

There are five key types of Mergers & Acquisitions:

The first four of these reflect the traditional bread–and–butter M&As. The last one, however, is the most powerful growth vehicle, because unlike the first four which are focused on providing moderate short and mid term gains, it is focused squarely on providing the biggest long term gain. Thus we refer to it as "the fifth wave" of M&As. Often, any given merger or acquisition of one of the first four types will actually yield some combination of the four, but this fifth type is rarely the product of happenstance. It has to be pursued with explicit focus and intent, and designed and orchestrated accordingly.

Sometimes – particularly when markets are undergoing heavy consolidation – the M&As are referred to as "roll–ups". When this happens, an increasing share of the market's presence, core capabilities, and throughput capacity end up being "rolled up" into a decreasing number of key players. Roll–ups generally produce one or more of the first four types of M&A, but not the fifth type.

Vehicle 4 represents inorganic growth.

Competitive Threat Elimination M&As are used to eliminate a particular competitive threat facing your business. This is usually a situation where two competitors of nearly equal stature – possibly two amongst a large pool of competitors – decide that each of their interests will be better served if they join forces rather than continue trying to fight one another. Thus they merge and become a single, larger player in the market, better positioning themselves to take on the rest of the competition. These mergers may be subject to anti–competition restrictions.

The main benefit of Competitive Threat Elimination M&As is the increased confidence they bring for the long term prospects of the resultant business. They also tend to result in some combination of increased market share, added technical or commercial capabilities, and expanded production / delivery capacity. Similarly, they tend to result in redundancies in certain functions, and these generally have to be rationalized through workforce reductions and capital liquidations. Once completed, this tends to yield higher overall operating efficiency.

The main risk in Competitive Threat Elimination M&As – besides the time, cost, and effort invested in integrating the two companies – lies in the fact that they do not eliminate all of the competition, and so it is still possible for a bigger and more powerful competitor to ultimately overpower even this resultant business, just as it is still possible for a new startup with a disruptive business model to come along and render the resultant business irrelevant. Efforts should be made to guard against this risk as best as can be done.

Capacity Expansion M&As are undertaken to gain additional production or service delivery capacities. This happens when you acquire or merge with a business and gain access to its capital and human resources (rationalizing where appropriate). This allows you to address a demand–growth situation you have encountered or anticipate, in which you opt to keep production or service delivery in–house so that you can maintain full control over the outcomes (e.g. cost, quality, and other factors that can impact profits, revenues, and brands). In the course of merging the two businesses, their respective product and service portfolios will need to be integrated, and decisions made as to which offerings to pare back in order to free up the added capacity that's needed for the high–demand situation.

The biggest benefit of Capacity Expansion M&As – aside from any market presence or capability that may be gained – is the ability to rapidly deliver additional outputs with minimal retooling, enabling you to respond quickly to growing demand situations and capitalize on major revenue–growth opportunities.

The biggest risk in Capacity Expansion M&As – besides the time, cost, and effort invested in integrating the two businesses – is the risk that the resultant business will still have inadequate capacity to meet demand. This risk is typically very low given that assessing capacity beforehand is usually a straightforward exercise.

Market Presence M&As are undertaken to expand your presence in particular markets. This happens when you acquire or merge with a business and inherit its customer base, thus expanding the overall customer base. Beyond that, it is still up to the resultant business to nurture, build, and further grow this expanded customer base. These M&As may be subject to anti–competition restrictions.

The biggest benefit of Market Presence M&As is the rapidly expanded revenues and market share they bring. This in turn results in more resources to invest back into marketing and R&D efforts for the combined enterprise.

The biggest risk in Market Presence M&As – besides the time, cost, and effort invested in integrating the two businesses – is the risk that customer loyalties will not actually carry over... that its customer base will not feel compelled to stick with the resultant business, or will in fact for some reason find the resultant business repelling and explicitly move to a competitor, thus not realizing the total combined customer base as had originally been anticipated. This can cause the M&A to not realize its projected return, and may even result in a net profit setback.

Capability Building M&As are undertaken to build additional technical and market capabilities. This happens when you acquire or merge with a business and integrate the core capabilities of the two businesses together. The focus here is on traditional core capabilities, as opposed to radically new capabilities (those being the subject of Innovation Synergy M&As). This allows the resultant organization to develop and deliver new core offerings that neither would have been capable of delivering otherwise. Given that these M&As involve traditional core capabilities, they will only take growth so far and for so long before other growth vehicles will be needed.

Closely related to Capability Building M&As are Technology Capture M&As. These are a special type of Capability Building M&A where the focus is explicitly on capturing a particular technology that the acquired / merged organization owns, so that your company now has sole and exclusive rights to the technology, along with any IP associated with it. This can allow you to do a couple of things. First, it can enable you to block or slow down competitors who lack comparable technologies, thereby capturing a larger share of the market while commanding a higher profit margin. Second, it can enable you to extract licensing royalties from those other companies who you do decide to license the technology to, providing for an additional source of revenue. Both of these represent potentially lucrative sources of value for your business.

The biggest benefit of Capability Building M&As – aside from any market presence or capacity that may be gained – is the ability to rapidly develop and deliver new core offerings based on this new broader set of capabilities. At this level however, these new capabilities do not in and of themselves make the company any more innovative; they simply make it able to deliver better value than either could have otherwise.

The biggest risk in Capability Building M&As – besides the time, cost, and effort invested in integrating the two businesses – is the risk that the resultant capabilities turn out to be less than what had originally been expected, leaving the resultant business little better off (possibly worse off) than it was before, given the other aspects of the merger it must contend with. This can happen if the two organizations' capabilities are overly redundant (too much overlap), in which case the real gain simply isn't there. This can cause the M&A to not realize its projected return, and may possibly result in a net profit setback if it is determined that certain plans are ultimately unachievable.

Innovation Synergy M&As are undertaken specifically to create entirely new innovation capabilities. These are radically new sets of non–core capabilities and offerings that, being more than the sum of their parts, are highly differentiated and cannot be easily replicated. This happens when you acquire or merge with another business having highly complementary capabilities – perhaps a competitor or a mature upstart – and the two companies combine their technologies, capabilities, and know–how to realize a whole new level of synergy. This synergy, in turn, yields an entire array of outcomes – new business models, new market strategies, new product categories, and so forth. All of these hold the potential to unleash greater value to the market and greater growth for the resultant business than could ever be achieved by either in isolation. This makes for a much higher return on the M&A investment than do traditional M&As.

Thus the main benefit of Innovation Synergy M&As – aside from any market share, core capability, and/or capacity expansion that may result – is the potential they bring for exponential growth, often associated with the ability to disrupt one or more markets.

The main risk associated with Innovation Synergy M&As – besides the time, cost, and effort invested in integrating the two businesses – is the risk that, for whatever reason, the hoped for synergies never fully materialize, and as a consequence the resultant business is never able to generate the types of breakthrough innovations it was supposed to. This will potentially yield a poor return, though it still may leave a viable business in place, just one without the competitive power it might have otherwise had.

With any type of M&A, a significant consideration is the large – sometimes highly leveraged – expense of financing the deal. Of all the growth vehicles, M&As typically represent the largest capital outlay. That being said, if both companies are sound and healthy, this can often be worked down in a relatively short period of time.

Another consideration is the necessity to integrate the two businesses into one. The M&A process itself may be straightforward or may be complex, depending on how well the two organizations can merge culturally and operationally. There will always be some differences to work through. If the cultures and core values are similar, it can be a smooth transition. If they are too disparate however, it can prove a difficult challenge. The more similar, the easier the process. There is also the risk of operational slowdown during the merger, particularly if the merger is not a good fit or is not well managed.

Finally, because the two businesses tend to be relatively mature and stable, both the technological and the commercial risks of M&As tend to be low. The exception is when a business being acquired is distressed, which usually presents numerous commercial issues requiring remediation. This is often the case of "paying on the front end" or "paying on the back end"... you can pay on the front end for a high caliber acquisition and begin reaping the rewards immediately, or you can pay on the back end by having to spend a lot of time, effort, and money fixing a distressed business that won't yield a return for a long time to come. Each company will have to make that decision for itself, according to its particular strategies, opportunities, and fiscal considerations.

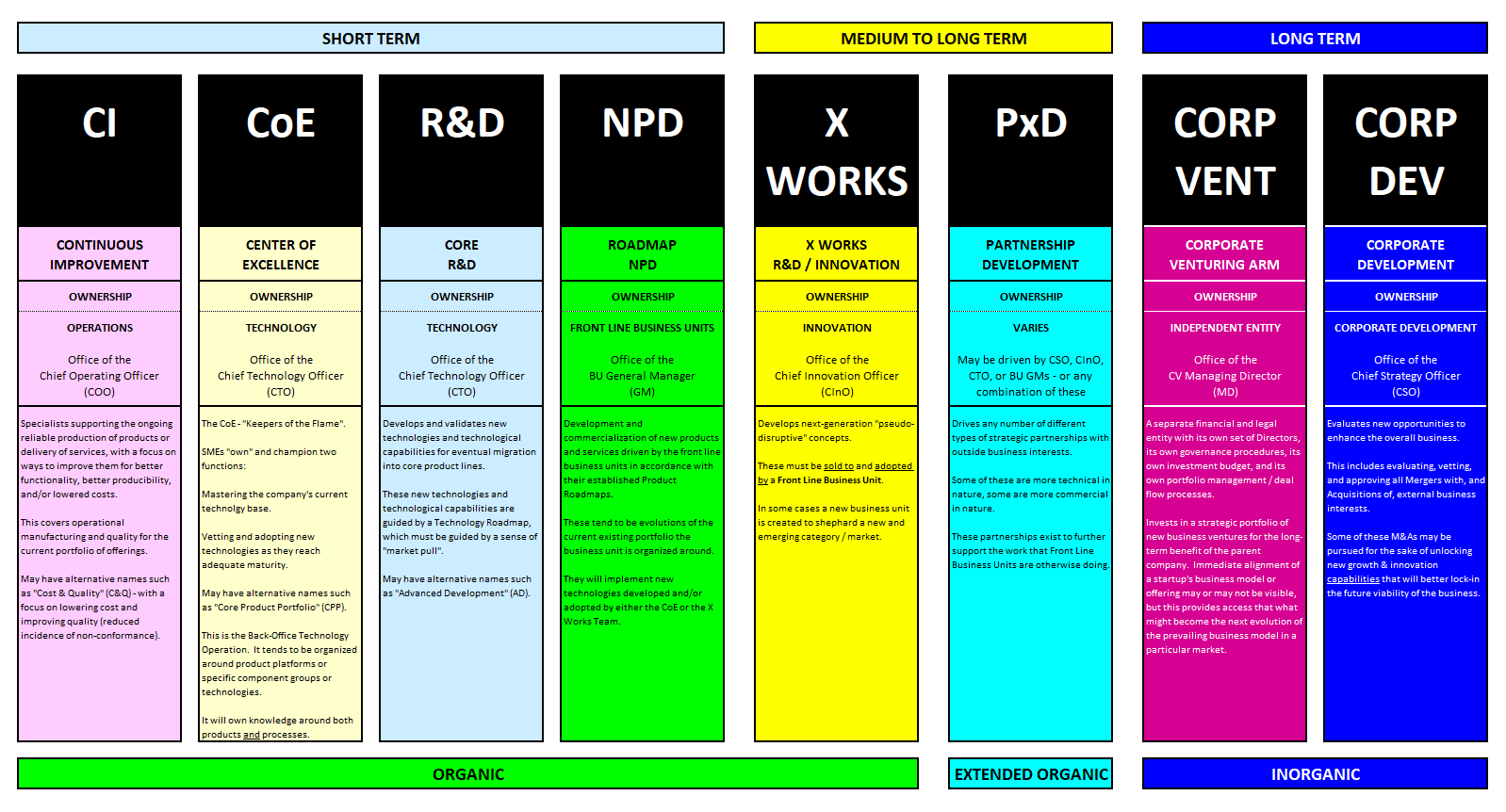

Organizationally, in order to take full advantage of all of the above Growth Vehicles in true portfolio fashion, your company will need to be structured and organized in a form resembling how the portfolio is put together. This includes designating appropriate C–Level executives to own and manage each of the functions (CSO, CInO, CTO, COO, GMs). So, if one's portfolio has all of the above elements, then their organization might be organized in the manner depicted in the following diagram.

Since all of these functions can be potential sources of innovation – some explicitly so, some less so – it is very important to have in place a systematic method for coordinating their combined efforts, according to some predetermined set of ground rules. This ensures that no two groups are unknowingly working on the same effort and thereby being capital inefficient (and potentially causing political friction). In most cases, because the focus and intent of each function is adequately different, this is usually not an issue. Where it could become an issue is if, for example, an X–Works Team were working on the same effort as, say, a CV–backed startup. In those cases, it will be best to either shift one of them or else agree that their respective approaches to the problem are adequately different such that taking both paths is in fact desirable. In terms of leading this coordination among the functions, this will generally fall to one of the senior executives from these functions. Since the overarching objective is to coordinate innovation and innovation–driven growth, this is usually a role best served by the Chief Innovation Officer (CInO). In some cases, however, seniority or political clout may dictate which executive will be most effective in this role. In either case, there has to be clear visibility and alignment on both the ground rules and the portfolio of efforts being pursued (see Governance Process within Responsive IE). This visibility and oversight should begin in the CEO's office.

Note also the inclusion here of a Continuous Improvement function. Though the CI function does not typically contribute a lot toward new innovation, its presence is nevertheless felt in supporting the other functions. Also in this arrangement Core R&D (which follows a Technology Roadmap) has been separated from Roadmap NPD (which follows a Product Roadmap). Such an arrangement allows Front Line Business Units to focus just on fast execution without having to manage an R&D function. Likewise, by allowing Core R&D to focus just on developing new technologies and technological capabilities, they do not have their focus unnecessarily divided either. A clear theme, therefore, is focus, which serves the company well if the overall effort is properly coordinated and there is a spirit of good cooperation between the functions.

We are sometimes asked... "what is the relationship, and the difference, between the GR5 Growth Strategy Playbook and innovation models like The Ten Types of Innovation, The Innovation Radar, or our own Future Lens Business Model Innovation Framework?"

The answer to that question is that the GR5 Playbook is a high-level strategic model, not a tactical innovation model – a model of how to leverage innovation to drive growth and resilience across the entire organization, rather than a model of how to innovate at any one specific time. As such, the GR5 Playbook looks at businesses and markets through the higher–altitude lens of strategy, whereas these other models tend to look only through the lens of individual tactics, and are therefore more suited to individual endeavors. Using those models in isolation can lead organizations to miss key opportunities because they do not first think holistically and strategically about how to accelerate growth overall.

As a strategic model, the GR5 Playbook asks some fundamentally different questions than do the tactical innovation models. In models such as the ones mentioned above, the underlying question is simply "how do we want to innovate?", or "how can we innovate?". But with the GR5 Playbook, there are two fundamental questions being asked... first, "where do we want to grow?", and second, "how do we want to leverage innovation to do that?". Thus, in keeping with good strategic innovation practice, it requires us to first address the "what, where, when, who and why" of our strategy before trying to address the "how". It is very important to answer the "how", and to answer it well, but it is the last part to be answered. As such, the GR5 Playbook sits as a layer atop, and prior to, the various tactical innovation models. It is the tool needed to inform and guide a comprehensive Corporate Innovation program. Tactical innovation models cannot do that.

This is what makes the GR5 Playbook a powerful tool for innovation–driven growth. It forces us to nail down a specific growth strategy before talking about how we want to innovate in any one case. Without this underlying growth strategy and the individual innovation strategies that flow out of it, how we want to innovate has very little context and meaning, and efforts quickly become unfocused, which is why so many of them never bear fruit (they become "opportunistic wanderings"... not unlike throwing darts blindfolded and hoping that one hits the dartboard). By forcing ourselves to first focus on where and how we want to grow, innovation efforts can then be far more focused, and thus effective.

These are the pathways and vehicles for innovation–driven growth.

At Legacy Innovation Group, we work with business leaders to help them determine which of these will be most optimal for their business, given its current growth and innovation objectives and its existing capabilities. Given that each pathway – as we progress from 1 to 6 – and each vehicle – progressing from 1 to 4 – requires an increasingly higher level of innovation maturity and capability, we also work with organizations to help them develop these as well.

In addition, if a company is to leverage this model and its growth strategies most effectively to drive its future growth, then it must ultimately become the type of organization that embraces uncertainty and that lives, breathes, and sleeps real innovation day–in and day–out. This means it will need to rethink its broader culture, strategies, processes, and workplaces so as to become an engaging market leader. We have the tools and know–how to help organizations do precisely that.

The GR5 Playbook provides the basis for our consulting work in Innovation Strategy. To learn more, please see our Innovation Strategy Consulting page, or to engage us in this capacity, refer to our Management Practice Engagement page.

The GR5 Playbook also provides the basis for our Innovation Strategy training course. To learn more, please see our Innovation Strategy Course page, or to engage us in this capacity, refer to our Training Engagement page.

CEOs come and CEOs go. Some are excellent. They generally ‘get it’. Others not so much. They really ‘don't get it’. What makes the difference between these?

READ MORE

There's an insidious debate that's bounced around for probably the better part of twenty years now. It's the debate of whether or not ‘innovation is everyone's job’...

READ MORE

Innovation Spaces – which can refer to any space intentionally designed to foster and facilitate good innovation work – come in all sorts, shapes, and sizes...

READ MOREWe partner with committed business leaders to make their organizations the driving forces in their markets.

CONTACT USSign up for our newsletter.

NEWSLETTER SIGN-UP